The Mobile Wallet is a virtual game card that FEC customers can add to their Apple Wallet or Google Wallet to pay and play games without downloading an additional app. It is the first of its kind in the industry and remains the ONLY FEC business solution that’s iOS and Android-compliant and approved.

Customers can simply register their game cards on the Embed Mobile Portal and immediately access their game card details, like balance information and ticket count. Customers can then add the virtual game card to their Apple or Google Wallets. With the exact functionality of a game card that lives within the customer’s mobile wallet, customers can easily tap and reload anytime, anywhere.

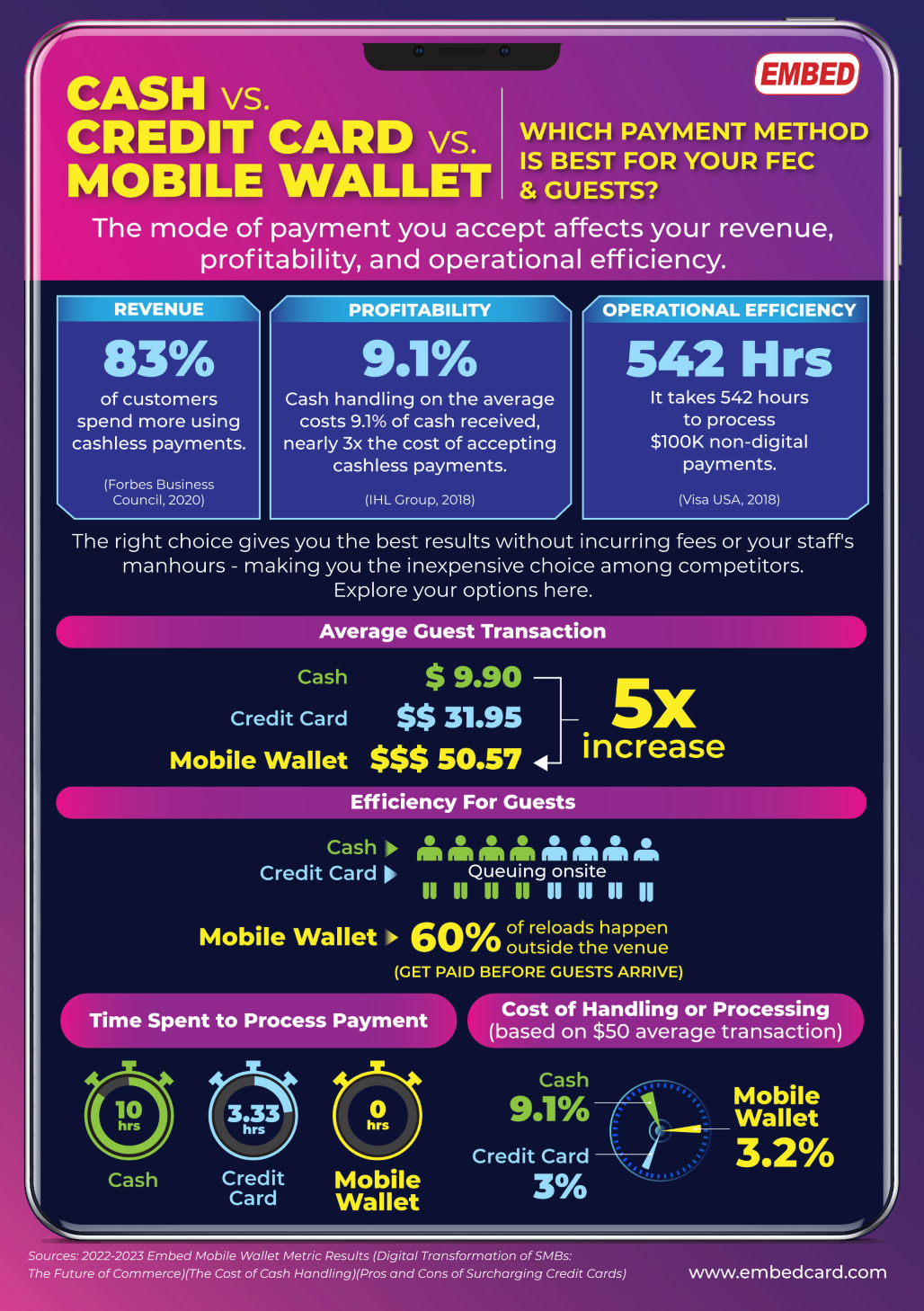

For the guest journey, this translates into:

1) Safety First Means Contactless

Due to the heighten emphasis on safety and hygiene in the COVID-19 era, consumers now expect businesses to take every conceivable measure to ensure a safe experience. Cash transactions have faced intensified scrutiny, and consumers increasingly favour contactless interactions to enhance the safety of their shopping experiences. Based on Visa’s 2020 Back to Business Study, 63% of consumers surveyed indicated they would switch to a business offering contactless payment options.

2) Seamless Guest Experience

With Mobile Wallet, guests no longer have to wait in line at the kiosk, cashier, balance-check machine, or prize redemption. Guests can self-serve and reloads can be done at guest’s own convenience – even before they enter the venue or while they are playing the game. In fact, operator’s results show that 60% of Mobile Wallet transactions happen before guests enter the FEC. As no additional app downloads are required, customers do not need to manage different apps across different venues.

3) Peace of Mind

With a virtual card, guests do not have to worry about misplacing cards. Advanced security and encrypted mobile technology protect game card-related information, allying fears of cyber theft. Customers can go big on their top-ups with ease of mind.

4) Operational Efficiency for FECs

Using Mobile Wallet eliminates coin/card jams and queue management issues, reducing guest dwell time. The average time spent to process cash payments is 10hrs. and 3.33hrs. for credit cards, vs 0 hours for Mobile Wallet. Greater operational efficiency means better resource management which improves the overall consumer journey.

5) Success Squad

As part of our service excellence commitment, we have set up an Embed Success Squad, a team of dedicated experts, to help transform our partner’s business at NO additional cost. FEC staff will receive in-store training to help guide their customers through the Mobile Wallet uptake process. We also provide marketing assets that our FEC partners can use for promotion.

Customer Results

The success enjoyed by operators is a testament to Mobile Wallet’s accessibility amongst their guests.

Both small and large FEC operators are showing the same average metric customer transactions:

- Average transaction: US$9.90 (cash) and US$31.95 (credit card)

- Average Mobile Wallet reload: US$50.57 – a 5x revenue increase vs cash and credit card transactions

Transformative revenue growth case studies based on Embed’s 22/23 success metrics:

- Customer with 21 locations: +2,839% growth (Oct 22-Jan 23)

- Customer with 6 locations: +431% growth (Jul 22-Jan 23)

In their aim to reach the teenage market segment, implementing Mobile Wallet was a big step forward for Yakima Family Fun Center. Kelsie Beath, General Manager, says “The Mobile Wallet is cool because guests can skip the line,” shares Beath. “We have these QR codes that guests can scan to encode their information, which is easier compared to other sign-ups where they ask for your whole credit history. For the Mobile Wallet, it’s just an email address and a password, and your game card goes straight to your digital wallet [in the mobile phone] – then go tap and play. It’s cool because everyone has a phone in their hand anyway,”